By Benoit Nguyen, Banque de France, and Jean-Stéphane Mésonnier, Banque de France[1]

It is now widely acknowledged that curbing global greenhouse gas emissions to reach the objectives set in the Paris Agreement of 2015 requires a major shift of global funding towards low-carbon activities.

How to achieve this re-allocation of private capital rapidly enough remains an open issue, however. Part of the debate revolves around making the carbon footprint of financial institutions and their exposure to climate risks more transparent to investors.

On the one hand, coalitions for sustainable finance have flourished in the financial industry since 2015, urging their members to enhance the disclosure of their exposure to climate-related risks and/or to voluntarily reduce the carbon footprint of their investments.

A prominent example of such a move is the Task Force for climate-related financial disclosure (TCFD), a global initiative backed by the G20’s Financial Stability Board.

On the other hand, regulators across the globe are concerned with allegations of greenwashing and are increasingly considering implementing mandatory climate-related disclosures for financial institutions – for instance, through the EU’s Sustainable Finance Disclosure Regulation or the recent endorsement by the G7 leaders of mandatory TCFD-like reporting.

What would more stringent reporting regulations achieve?

In a new study we show that imposing climate-related disclosures on financial institutions actually leads them to divest from carbon-intensive securities.

We assess the effects of the French Energy Transition and Green Growth Act – the TECV law – whose Article 173-6 pioneered climate-related disclosure in Europe.

The law, which was passed in August 2015 in the run-up to the COP21 and came into force in January 2016, imposes detailed reporting requirements on institutional investors registered in France related to their climate-related risk exposure and their efforts to mitigate climate change. For example, investors need to estimate the global temperature trajectory to which their portfolio is aligned.

While the list of required disclosures is comprehensive, investors can answer on a comply-or-explain basis and can choose their preferred evaluation methodologies.

We look for the impact of these new disclosure requirements in terms of induced portfolio adjustments out of carbon-intensive securities. We therefore focus on investors’ holdings of securities issued by firms in the fossil energy industry (i.e. firms operating in the extraction, production, and transport of fossil fuels). For investors faced with increased transparency requirements on the carbon intensity of their portfolios, divesting out of such firms is a relatively quick and easy way to comply with new climate-related objectives and communicate to the public (by publishing, for instance, plans to exit from the coal sector).

Methodology

We construct an exhaustive dataset of all bonds and stocks that were issued by fossil fuel companies worldwide – across sub-sectors including coal mining, offshore oil drilling, oil pipeline transportation and petroleum refining – and that were outstanding between Q4 2013 and Q3 2019[2], using two widely used industry classifications: Thomson Reuters’ Business Classification (TRBC) and Bloomberg’s Industry Classification system (BICS).

We track the holdings of these securities by Eurozone investors, using a unique database maintained by the Eurosystem (Securities Holdings Statistics).

Our working sample consists of half a million observations about some 7,000 unique securities issued by 2,757 distinct fossil fuel companies in the world and held in the portfolios of eurozone financials.

We consider three types of financial institutions in eurozone countries: banks, insurance companies and pension funds, and all other asset management firms and mutual investment funds. The provisions of the TECV law explicitly target the last two, commonly dubbed institutional investors, but not banks.

As the law only applies to institutions domiciled in France, and no similar legislation existed in any other eurozone country before 2019, this provides us with neat treated and control groups. We compare the holdings (at market prices) of these treated groups before and after December 2015, with holdings by banks in France and all financial sub-sectors in all other countries (control sectors).

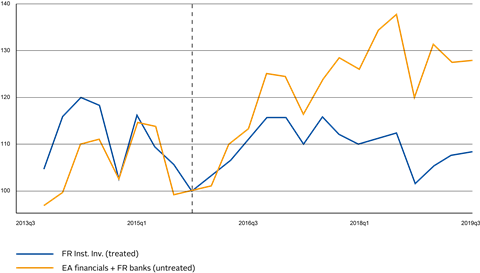

As shown in Figure 1, while the combined portfolio holdings of both groups broadly converge before the new regulation, they diverge notably afterwards.

We find that fossil fuel holdings in the portfolios of institutional investors targeted by the mandatory reporting decrease sharply once the law was implemented, compared to holdings by financial institutions not targeted by the law.

The effect of the mandatory climate-related disclosure on investments into these carbon-intensive companies is statistically and economically significant: French institutional investors reduced their holdings by some 40% on average. Furthermore, we find that treated investors are also less likely to hold fossil fuel securities altogether under the new regulation.

Notably, we find that the impact of this regulation is about twice larger for investments in companies exploiting mostly coal and unconventional fossil fuels instead of conventional oil and gas. We also find evidence of a strong home bias in the reaction of eurozone investors: treated institutions only make large and significant divestments to reduce their exposure to non-eurozone fossil fuel issuers.

These findings vindicate the planned extensions of mandatory climate reporting by financial institutions, in Europe and beyond. Indeed, the relative effect that we identify after 2016 still holds out at the end of our sample in 2019, although many large financial institutions in Europe had by then joined coalitions of investors committed to fight against climate change.

In line with the findings of Bingler, Kraus and Leippold, who point to “cheap talk and cherry-picking” behaviour in the climate reporting of TCFD members, our study suggests that more stringent regulations on carbon reporting by investors are essential to speeding up the alignment of finance with the urgency of the energy transition.

This blog is written by academic guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase research in support of our signatories and the wider community.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected]

References

[1] The opinions expressed are the authors’ own and do not necessarily reflect those of the Banque de France or the Eurosystem.

[2]Note that a new French law, the Energy and Climate Act of November 2019, changed some of the TECV law’s initial provisions, notably extending them partly to banks.